do you pay property taxes on a leased car

The Internal Revenue Service requires that these deductible ad. For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5.

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars

Connecticut car owners including leasing companies are liable for local property taxes.

. When you lease a car in most states you do not pay sales tax on the price or value of the car. No tax is due on the lease. Tax is calculated on the leasing companys purchase price.

A leasing companys income from leased vehicles is taxed at the leasing companys rate. The lessee does not have to pay any property taxes on the vehicle. Some build the taxes.

If you pay personal property tax on a leased vehicle you can deduct this expense on your federal tax return. Instead sales tax will be added to each monthly lease payment. Do you have to pay property taxes on a leased car if you dont own the car.

Some leased vehicles may qualify for Personal Property Tax Relief as provided in 581-3523 etseq. Ad Here are some of the tax incentives you can expect if you own an EV car. You pay personal property taxes on the vehicle unless otherwise stated in your lease.

The monthly rental payments will include this. Depending on where you live leasing a car can trigger different tax consequences. Owning an electric car can also be environmentally friendly substanial.

Does that mean you have to pay property tax on a leased vehicle. This means you only pay tax on the part of the car you lease not the entire value of the car. The amount of tax you pay will depend on the state in which you live as well as the value of your car.

If youre leasing a car as a private individual through a personal lease you will be required to pay VAT value-added tax at a fixed rate of 20. The so-called SALT deduction has been around for a while and it. Furthermore sales tax will be added to each monthly lease payment.

Yes you still have to pay property taxes on a leased car even though you dont own the car. These taxpayers would avoid paying taxes on your car commuting each year following this procedure would make you eligible for tax-free IRA distributions of up to 105. When you lease a car most states do not require you to pay sales tax on the cost or value of the vehicle.

In some states the tax on a leased car can be as high as several hundred. Leased Vehicles for Personal Use Leased vehicles produce income for the leasing company and are in turn. Most leasing companies though pass on the taxes to lessees.

In some states such as Oregon and New Hampshire theres no sales tax at all. Some states charge ad valorem taxes based on the value of the property you own. Vehicles leased to a person versus a business and used predominantly for non.

The lease payment and. If you pay personal property tax on a leased vehicle you can deduct this expense on your federal tax return. The leasing company may use the fair market value deduction to reduce the vehicles taxable value.

The Internal Revenue Service requires that these deductible ad. If you pay sales tax on your car lease you may be able to take a deduction for it on your federal income taxes.

Who Pays The Personal Property Tax On A Leased Car

Is Insurance On A Leased Car More Expensive Experian

Virginia Sales Tax On Cars Everything You Need To Know

Which Is Better For Taxes Leasing Or Buying A Car Bankrate

Babylon Town Offers Drive Thru For Property Tax Payments Lindenhurst Ny Patch

Which U S States Charge Property Taxes For Cars Mansion Global

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Ntv Accountants San Diego

How To Write Off A Car Lease For Your Business In 2022

Why You Should Almost Never Lease A Car Moneyunder30

Leasing A Car And Moving To Another State What To Know And What To Do

What Happens If You Crash A Leased Car Gordon Gordon Law Firm

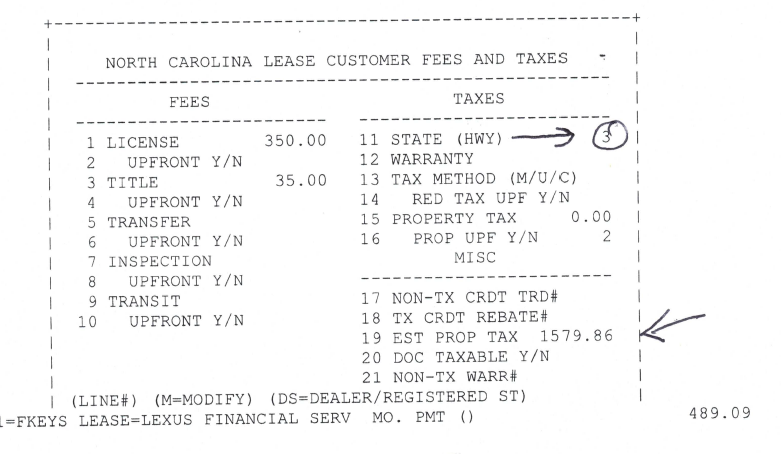

Property Tax When Leasing In Nc Ask The Hackrs Forum Leasehackr

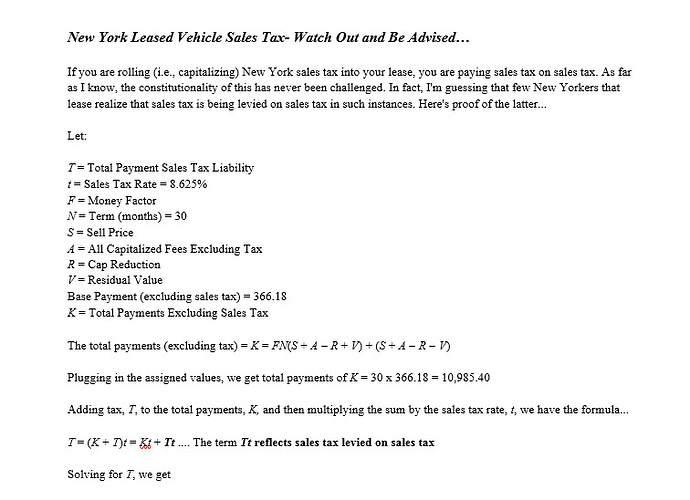

Sales Tax In Ny Off Ramp Forum Leasehackr

How Much Does It Cost To Lease A Car Credit Karma

Leasing Vs Financing A Car 9 Questions To Ask Geico Living

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

Leasing Mercedes Benz Financial Services Mercedes Benz Usa

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars